This Weekend on IP Wave: India's Golden Headache

Remember that old adage, "as good as gold"? Well, in India, gold is good. Better than good, it's a lifeline, a rainy-day fund, and a cultural representation of celebration all rolled into one. So, when the news broke about the slashed gold import duties in the 2024 budget, it wasn't just the markets that took notice. Millions of households felt the shock through one of their most important assets - an estimated worth of over 1.5 trillion, more than the GDP of most countries.

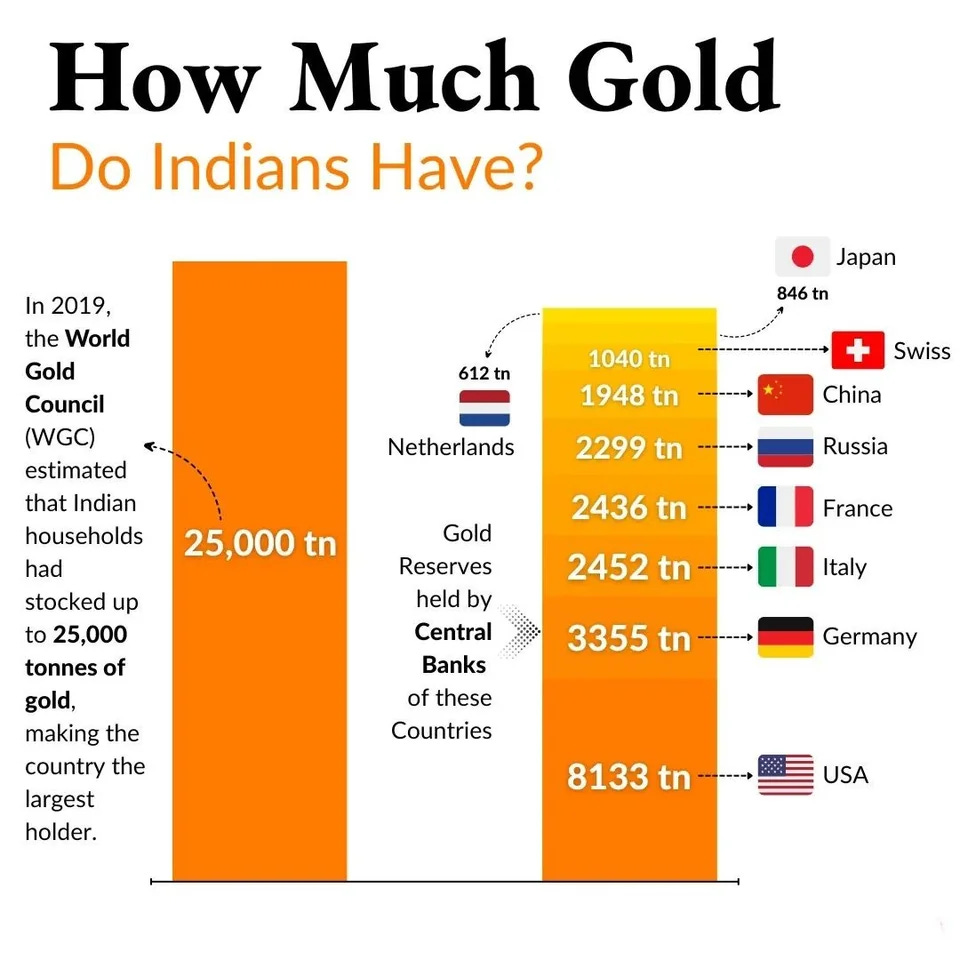

On the face of it, cheaper gold sounds like a win. But economics, as we know, loves a paradox. India is a gold-hungry nation, holding an estimated 25,000 tonnes, which is more than the USA, Germany, Switzerland, and the IMF combined. Much of this is held not in bank vaults, but in homes, often by women, as a form of informal security.

This is where things get interesting.

A sudden price drop, while good for jewelry buyers, throws a wrench into this system. Imagine you're a woman who's painstakingly built up a small fortune in gold bangles, only to see their value dip overnight. Your ability to take out a loan against them shrinks, your safety net feels less secure, and the future suddenly seems a bit more precarious.

Then there's the gold loan industry, a vital source of credit for many Indians, especially in rural areas. The recent economic downturn, exacerbated by the pandemic, has forced many Indians to turn to their gold holdings for financial support. The gold loan market, worth $80.12 billion in 2023, has become a lifeline for individuals and small businesses alike, with companies like Muthoot and Manappuram emerging as major players. Lower gold prices mean lower loan-to-value ratios, making lenders more risk-averse. Will this make credit harder to come by just when it's needed most, especially for those who rely on informal lenders, who dominate 65% of the market?

The government's aim – to curb smuggling and boost legitimate jewelers – is laudable. But as with any economic intervention, there are unintended consequences. This is a reminder that sometimes, the most valuable things aren't measured in rupees or percentages, but in the intricate web of trust, tradition, and security they represent.

Data Dive:

IP Round-Up

FDI and Phone Imports from China: Insights from the Economic Survey 2024

The Economic Survey 2023-24 discusses India's approach to FDI and imports from China. India is adopting a "China Plus One" strategy to reduce dependence on China, particularly in high-tech electronics and components, and attract FDI from Chinese companies. This strategy aims to boost India's exports to the US and other markets. The survey also highlights the government's focus on increasing domestic smartphone manufacturing and assembly through initiatives like the Production Linked Incentive (PLI) scheme. It has also proposed a reduction in the Basic Customs Duty (BCD) on mobile phones and related components. Specifically, the BCD on cellular mobile phones, mobile Printed Circuit Board Assembly (PCBA), and chargers/adapters has been reduced from 20% to 15%. This aims to support the maturing Indian mobile phone industry, which has seen a significant increase in both domestic production and exports

Artificial Intelligence and the Economy: Implications for Central Banks

BIS Annual Economic Report 2024 discusses the rapid adoption and transformative potential of generative AI (gen AI) on the economy and central banks. Gen AI, powered by large language models (LLMs), can structure unstructured data, enhancing productivity and decision-making. Key challenges include:

Impact on Financial System: AI influences productivity, investment, consumption, and wages, affecting macroeconomic stability. Central banks must anticipate these changes and use AI to maintain monetary and financial stability.

Data and Governance: Central banks need to prioritize data availability and governance, fostering collaboration to share knowledge and tools, enhancing their operations and policy effectiveness.

Read the report here

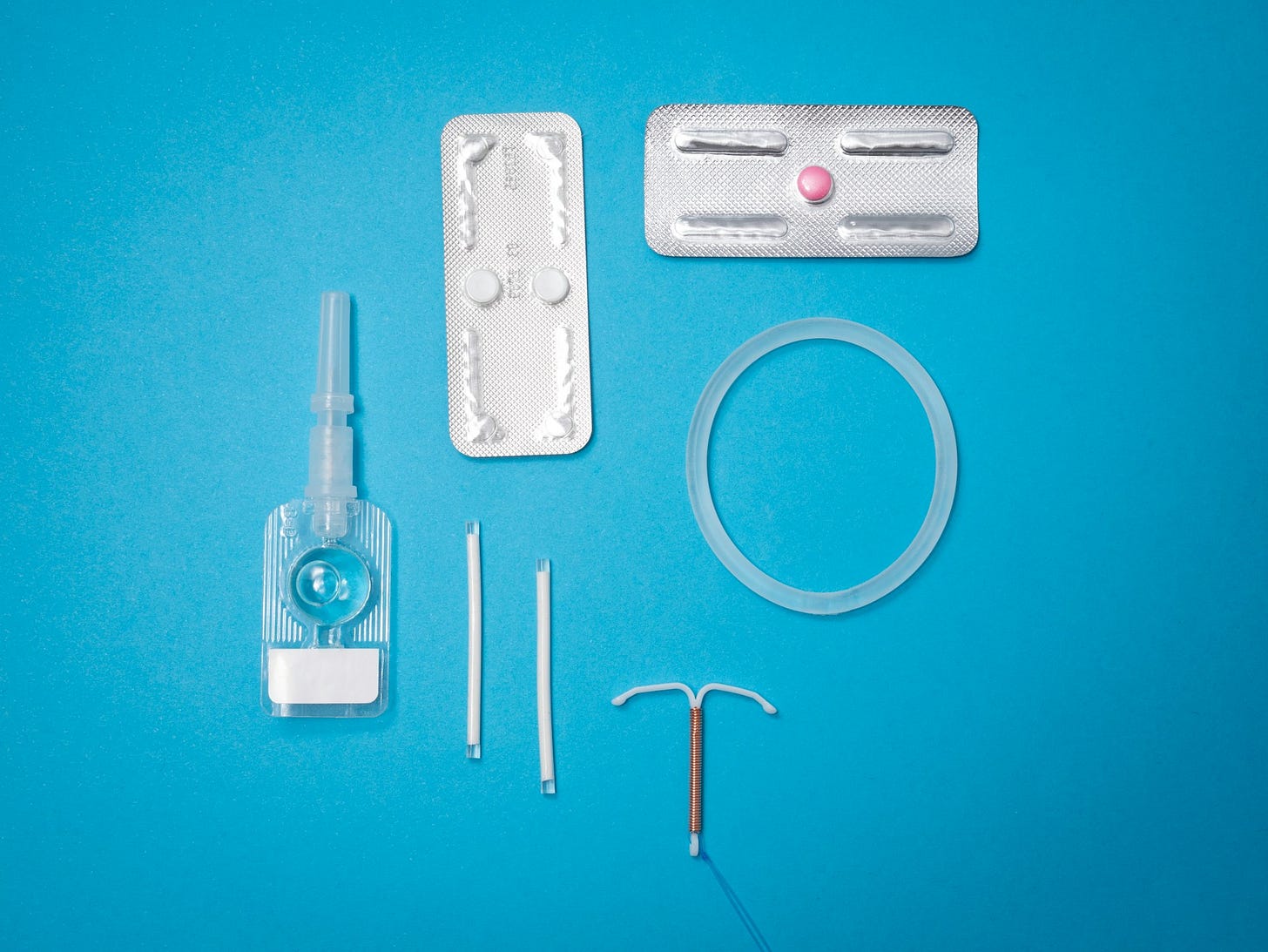

No Effect of Free Contraception on Birth Rates in Rural Burkina Faso

In a study conducted in rural Burkina Faso, free access to all contraceptive products was provided in local public health centers for three years, but this intervention did not affect birth rates. This study challenges the assumption that financial barriers are the main impediment to contraceptive use in high fertility contexts. The findings suggest that merely improving access to contraception might not reduce fertility rates as expected. Instead, a broader approach addressing economic conditions and cultural norms could be more effective in influencing fertility decisions.

Gender Gaps in China's Gig Economy Amplified by Algorithms

Research by Yutong Chen at the University of Texas at Arlington reveals that algorithms on a Chinese online healthcare platform exacerbate gender disparities, favoring male physicians. Despite lower pricing by female physicians, they receive fewer consultations and earn significantly less. The study indicates that the platform’s ranking algorithm, influenced by past patient preferences, perpetuates these disparities. This underscores the need for revising algorithmic mechanisms in the gig economy to promote gender equality. The learning here is that the gig economy reflects societal biases, necessitating targeted reforms to ensure fair opportunities for all genders.