This Weekend on IP Wave: How Borrowing Became an Aspiration

Hello reader,

There's an old joke about a fellow who, when asked why he robs banks, says simply: "Because that's where the money is." Simple logic, right? But it seems the money in today's world isn't just in banks but in the ease of accessing credit right from our pockets, aka, smart phones.

Remember when borrowing money was reserved for the big emergencies in one's life, be it a medical bill, some unexpected repair for the house, or possibly the education of a child? Fast forward to today, and the landscape has changed dramatically. According to Home Credit India's latest report, How India Borrows, 44% of borrowers in 2023 took out loans for consumer durables like mobile phones and home appliances. RBI data confirms this shift.

It's as if we've decided that owning the newest smartphone is as essential as food and shelter. But what's driving this shift from borrowing out of necessity to borrowing out of desire?

Well, for one, digital lending platforms are making loans feel less like a financial burden and more like an opportunity. 30% of consumers now prefer taking loans through digital platforms, with mobile apps emerging as the go-to medium for seamless transactions. This trend is particularly strong among Gen Z and Millennials in India’s Tier 1 and 2 cities, who are embracing the ease of digital credit.

Of course, it’s not just about technology. There’s also the powerful pull of aspirational consumer culture—we see something on Instagram, we want it, and now we have the means to get it. Add to that the pandemic-driven shift in spending priorities, where we all decided it was time to upgrade our home entertainment systems or buy the latest gadget, and you have the perfect storm for lifestyle-driven borrowing. It's the classic present bias in action: we overvalue immediate rewards (a shiny new phone) and underestimate future costs (those pesky EMIs).

But there's a darker reality. The same report shows that despite the widespread use of digital platforms, only 23% of borrowers actually understand how their personal data is being used by loan apps. Think about that for a second—most people are handing over their sensitive information without knowing what happens next.

So, where does that leave us?

Are we just being nudged into a "borrow now, think later" mentality,

or are we in control of our choices? Perhaps the answer lies somewhere in between or perhaps not.

But one thing's for sure: borrowing has never been this easy—or this complicated. The challenge ahead is clear—can we truly understand what we’re signing up for, even as it gets easier to do so?

After the Nobels, Meet the Ig Nobels:

The 2024 Ig Nobel prizes, awarded for science that “makes people laugh, then think,” didn’t disappoint. Among this year’s quirky winners were studies on worms getting drunk, mammals breathing through their anuses, and plants mimicking plastic counterparts. B.F. Skinner’s pigeon-guided missile project from the 1940s won a posthumous peace prize, while research on painful placebos took home the medicine prize. Equally bizarre was a coin-flip study confirming that the starting side often determines the outcome, while a team of demographers exposed suspicious longevity records. The event wrapped up with a nod to explosive milk-spilling experiments involving a cow, a cat, and a paper bag.

How Field Experiments Are Shaping Economics

Field experiments in economics take place in the real world, observing how different conditions influence outcomes in daily life. Unlike lab experiments with students as subjects, these studies look at real activities—work, shopping, or giving to charity. Since the 1960s, large-scale social experiments have tested programs like job training and housing, offering policy insights. But here’s the catch: what works in a small experiment doesn’t always scale well. Economist John A. List argues that we need to think beyond 'petri dish' successes, considering real-world challenges from the start to ensure meaningful, lasting economic solutions. Read more at conversable economist

How to Win a Nobel Prize (Kind Of)

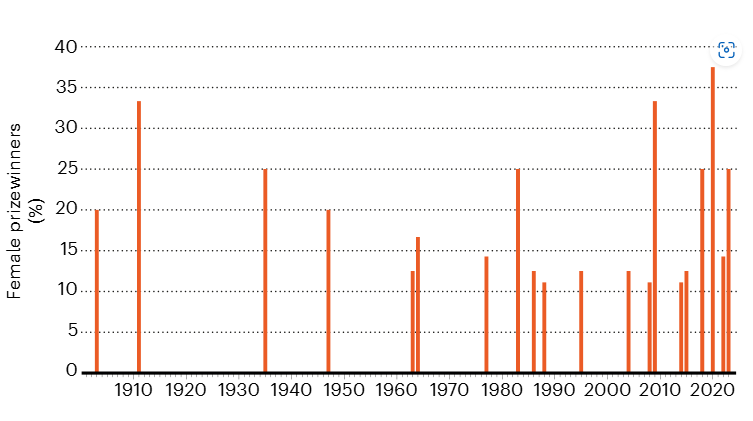

Want to win a Nobel Prize? Start young and aim to make a splash by your 50s—most winners are 54. Male winners still dominate, especially in physics and chemistry, but recent years have seen more female laureates in medicine. Be prepared to share the glory: most awards involve at least one co-winner. Geography matters too—more than half of all winners live in North America. Academic connections also help: almost all winners trace their roots back to a previous laureate. And if all else fails, having a name starting with 'J' or 'A' might give you a quirky edge! Read more at the interactive page at Nature.

Is “Fake News” Really the Biggest Threat?

When people talk about misinformation, they often think of "fake news" from disreputable sources. But the real problem runs deeper. Research shows that misleading information from trusted outlets—like sensational vaccine stories or political rhetoric—can have a much greater impact on public opinion than fringe fake news. Combating this issue isn’t just about debunking viral falsehoods; it requires holding mainstream media and political elites accountable for how they shape narratives. Addressing misinformation must go beyond fact-checking, focusing on the broader ecosystem of information we trust and consume daily. Read more at Scientific American.

💡 Written by Farheen