The Race for Sustainability Has a Rare Earth Monopoly Problem

The top 40 mining corporations in the world, which make up the great majority of the sector, generated almost 925 billion dollars in revenue in 2021. About 280,000 metric tonnes of rare earth oxides were produced globally in rare earth elements in 2021.

Around the world, many sectors rely on the subsurface supply of mineral products. The dependence of numerous high-tech businesses on rare earth is increasing whereas on the other hand, coal continues to rank among the top global energy sources. As a result, the mining industry is crucial to the global economy. The top 40 mining corporations in the world, which make up the great majority of the sector, generated almost 925 billion dollars in revenue in 2021. About 280,000 metric tonnes of rare earth oxides were produced globally in rare earth elements in 2021.

The so-called rare earth elements (REEs) are not as uncommon as their name may imply. Mineable deposits are few, nevertheless. The earth's crust contains a variety of "rare" earth, some of which are as prevalent as less uncommon elements like tin, despite their name. Because of their typical low concentration within deposits and the presence of radioactive elements in some REE deposits, REEs continue to go by this name.

A group of 17 metallic elements is known as rare earth elements (REE). These comprise the 15 lanthanides listed in the periodic table, in addition to scandium and yttrium. REEs (rare earth elements). The U.S. Geological Survey estimates that in 1993, China produced 33% of the world's REEs, followed by the United States with 33%, Australia with 14%, Malaysia with 5%, and India with 5%. The remaining nations included Thailand, Sri Lanka, Brazil, Canada, South Africa, and Sri Lanka. China now meets around 97% of global demand and generates over 95% of the world's REE output. Prior to the 1980s, the Mountain Pass deposit in California, which used to be the main source, was closed in 2000 because of environmental concerns around the difficult manufacturing method and reduced market value.

High-tech products including cellphones, digital cameras, computer hard drives, fluorescent and light-emitting diode (LED) lights, flat-screen televisions, computer monitors, and electronic displays all use rare earth elements as component parts. Some REEs are employed in large amounts in renewable energy and defence industries. Anodes for nickel-metal hydride batteries are made of alloys based on lanthanum. These battery types include considerable quantities of lanthanum when used in hybrid electric vehicles, requiring up to 10 to 15 kg per electric vehicle. The major user of REE raw materials is the glass industry, which also uses them as additives to impart colour and unique optical qualities to glass as well as for glass polishing. Digital camera lenses, including those in mobile phone cameras, can contain up to 50% lanthanum.

Rare-earth magnets are more potent per unit of weight and volume than any other type of magnet. Huge wind turbines and electric vehicles both employ rare-earth permanent magnets or those that have been magnetised permanently. These magnets generally include four REEs: dysprosium, samarium, praseodymium, and neodymium.

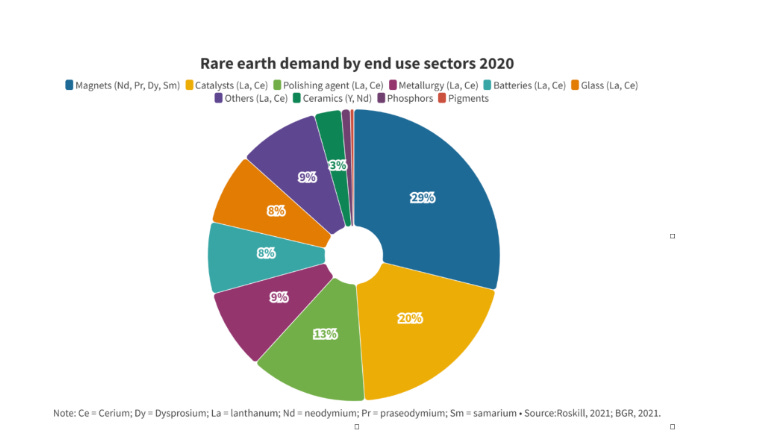

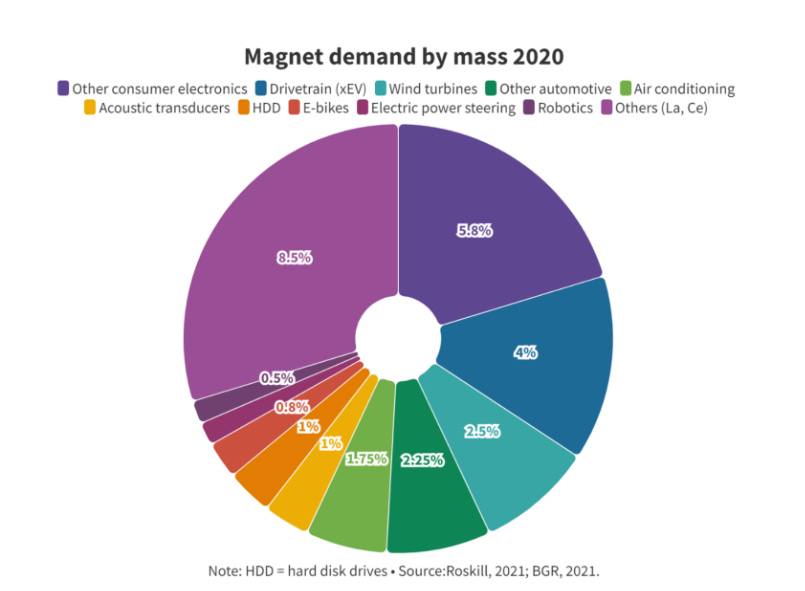

These elements' distinctive optical and magnetic characteristics are attributed to causing the rapid REE boom. According to IHS Markit, 34% of the demand for REEs in 2019 came from magnets. According to Roskill (2021), reports reveal that the largest single-ended application, rare earth permanent magnets, accounted for 29% of total demand in 2020. By 2030, magnets are expected to account for about 40% of total demand. Rare earth elements (REEs) are also commonly used in traditional clean energy applications. Batteries accounted for 8% of REE demand in 2020. REE consumption in the battery industry is solely due to the application of REE in nickel metal hybrid (NiMH) batteries containing 18-28 wt% lanthanum, depending on the anode chemistry. The catalysts accounted for 20% of REE demand in 2020. Cerium is widely used as a catalyst in automotive catalytic converters. Ceria is also used as a catalyst for cracking petroleum in petroleum refining. Lanthanum oxide is used as a catalyst in the production of polyvinyl chloride (PVC). According to the US Geological Survey (USGS, 2021a), REE production in 2020 was 240 kt as rare earth oxide equivalent. Out of these, 50 kt is neodymium oxide. 70 kt of the total 240 kt is used for magnets suggests that most neodymium is used for this purpose. This equates to a 6-9 kt requirement for neodymium oxide for vehicle engines, or 2-4% of the total REE requirement. About 10% of all permanent magnets were used in wind turbines. Transportation applications account for about a quarter of magnet usage, half of which is for drivetrains (EV motors).

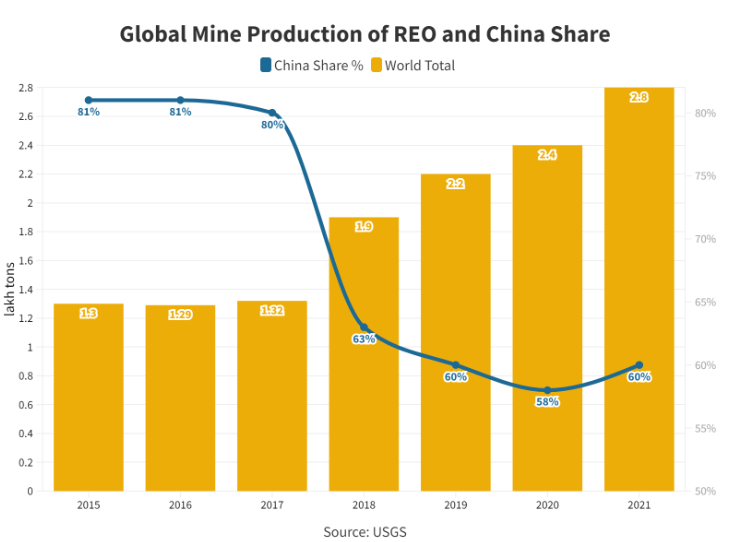

In 2020, 240,000 tons of rare earth oxides were produced. Nearly 60% of production took place in China, followed by the United States, Myanmar and Australia. These four countries accounted for over 90% of global production in 2018. The United States' strong mining position is not supported by equally strong resource reserves or processing capacity, and the country's mined minerals are mainly shipped to China for processing. In the long term, therefore, other countries will need to take on the role of mining and processing to ensure a diversified supply.

Demand expectations differ depending on the source, with demand growth estimates more than double the low. According to Adamas Intelligence, worldwide demand for mined neodymium and praseodymium oxide will reach around 7 kt per year by 2028. It should be emphasised that, in comparison to the megatonne-scale production and consumption of other mineral and metal commodities, the total amounts involved are very tiny. Permanent magnet demand might increase from 50 kt to 225 kt per year by 2030, with EV's accounting for 180 kt and wind turbines accounting for 50 kt.

Recently, the U.S. Department of Defense and Malaysian rare earth miner and processor Lynas Rare Earths decided to develop a commercial light rare earth separation facility in the U.S. Lynas will also contribute an additional $30 million to the project. Once operational, the facility will employ feedstock material from a cracking and leaching operation the business is establishing in Kalgoorlie, Western Australia, to manufacture around 5,000 tonnes of rare earth products yearly, including 1,250 tonnes of neodymium-praseodymium.

According to a report from Reuters, the Russian government intends to invest $1.5 billion by 2030 in 11 rare earth projects. The news source claims that the Russian government is providing loans at lower interest rates and decreased mining taxes to investors in the projects. With output anticipated to reach 7,000 tonnes of rare earth concentrates by 2024, the incentives are intended to enhance Russia's contribution to global rare earth production from 1.3% to 10% by 2030.

Namibia Critical Metals and Japan Oil, Gas and Metals National Corporation (JOGMEC) inked a contract in January of last year to jointly explore, develop, and refine mineral products from Namibia Critical Metals' Lofdal heavy rare earth deposit in the country's northwest. JOGMEC will receive a 50% stake in the project in exchange for a $20 million investment in exploration and development.

Global mine production was estimated to have incremented to 2.8 lakh tons of rare-earth-oxide (REO). According to China’s Ministry of Industry and Information Technology, the mine engenderment quota for 2021 was 1.68 lakh tons with 1.49 lakh tons allocated to light rare earths and 0.19 lakh tons to ion-adsorption clays. The data shows that from 2015 to 2017, China's REO mine production exceeded 80% of the world's total.

US imports of rare earth compounds and metals are estimated at $160 million in 2021, up from $109 million in 2020. The estimated end-use distribution of rare earth is: catalysts, 74%; ceramics and glasses, 10%. Metallurgical applications and alloys, 6%. polishing, 4%; other, 6%. Most of the compounds and metals were imported from China (78%), Estonia (6%), Malaysia (5%), Japan (4%) and others (7%). Compounds and metals from Estonia, Japan and Malaysia were extracted from mineral concentrates and chemical intermediates produced in Australia, China and elsewhere. In 2021, approximately 45,769 tons of rare earth ores and compounds were exported from the United States. That was an incrementation of more than 42,000 tons in just four years.

Intellectual property (IP), particularly patents, is increasingly important for the mining industry. Large mining enterprises and firms specialising in mining equipment, technology and services (METS) increasingly use IP to pursue their internationalization strategy. Between 1990 and 2015, there were 663,322 inventions filed for patent protection related to mining technology. The mining subsectors with more innovation are the exploration and refining of extracted materials. Other fields involve less innovation: blasting, environmental improvements, metallurgy, mining, processing and transport.

The industry has encouraged the government to promote private-sector mining in the sector and diversify sources of supply for these crucial raw materials to counter India's dependence on China for imports of vital rare earth minerals. The Confederation of Indian Industry (CII) has submitted suggestions for encouraging private players to mine these minerals, including "setting up an 'India Rare Earths Mission', manned by professionals, like the India Semiconductor Mission and make their exploration a critical component of the Deep Ocean Mission plan of the government". Even though India contains 6% of the world's deposits of rare earth, it barely contributes 1% to global production and gets the majority of the rare earth minerals it needs from China's industrial sector.