The Digital Public Good UPI Goes Global: Can it Overtake SWIFT?

One of the major objectives of Digital India is to achieve “Faceless, Paperless, Cashless” status. The Unified Payment Interface (UPI) saw a significant surge in usage in January 2023, with almost eight billion transactions valued at approximately $200 billion taking place on the platform. Currently, digital payments account for 40% of all transactions in India, with UPI contributing to over 68% of total payments. In March 2023, UPI witnessed 8.7 billion transactions alone, marking an 82% increase in usage in the financial year 2022-23 compared to the previous year. The number of smartphone mobile network subscriptions worldwide reached almost 6.6 billion in 2022 and is forecast to exceed 7.8 billion by 2028.

The Rise in Payments: Enabling Policies & Network Effects

The roots of electronic payments lie in 1871 when Western Union debuted the electronic fund transfer (EFT). However, the term "contactless payment" refers to a relatively recent development.

Digital payment in India has come a long way since the Central Bank of India issued the first credit card in 1980. HSBC installed the first ATM in Mumbai in 1987. The emergence of BillDesk in 2003 and the launch of Oxigen Wallet in 2004 marked the beginning of a new era of electronic banking. National Electronic Fund Transfer (NEFT) was established in 2005, followed by the public launch of Immediate Payment Service (IMPS) in 2010, the RuPay card scheme in 2012, and UPI in 2016. The introduction of e-RUPI in 2021 marked a significant milestone in the development of digital payment methods. Reports suggest that India's digital payments market will more than triple from $3 trillion to $10 trillion by 2026.

Alibaba and Tencent pioneered the shift towards digital payments in China, with Alibaba integrating Alipay in 2003 and Tencent integrating Tenpay in 2005. WeChat which started as a messaging app in 2011 had a transaction of around $400 billion on the platform in 2021.

India is pushing to promote digital public infrastructure (DPI), such as its digital ID system, Aadhaar, and its Unified Payments Interface (UPI), in developing countries while expanding the cross-border acceptance of UPI among friendly nations. UPI has already seen success in countries such as Singapore, Bhutan, and Nepal, and from April 2023, it will facilitate remittances in 10 locations, including the UAE, Australia, and Hong Kong. Private companies such as Google Pay and PhonePe have developed apps using UPI. However, all UPI traffic flows through the Indian banking system, and the underlying tech is owned by the government, with cutting-edge innovation by private companies. The government has also built India Stack, an interlinked set of digital platforms built on Aadhaar, for various services such as payments, e-signatures, and health apps.

A major reason behind the push for the internationalisation of UPI is the need to mitigate geopolitical risks and find alternative payment systems that can overcome the impact of economic sanctions, which are often used by Western countries as a form of economic punishment.

This need for an alternative system has been highlighted by the actions of Western countries, where every bank headquartered in Russia was thrown out of the SWIFT monetary system due to the ongoing Russia-Ukraine conflict, resulting in significant losses for the Russian economy. According to estimates, the Russian economy is said to have lost 10-15% of its GDP due to the sanctions. In March 2012 Iran was banned from SWIFT because of this Iran lost 30% of its foreign trade and oil export revenues.

In order to overcome such restrictions in the future and break the monopoly of SWIFT, a Belgium-based financial system that enables seamless and speedy transmission of money across borders. Amid international sanctions, the world needs to find alternatives.

India has partnered with banks and payment companies in countries such as the US, the UK, Singapore, Saudi Arabia, Oman, and the UAE to make UPI available to the Indian diaspora or Indian tourists. The government is also striking partnerships with other countries to increase UPI's reach and bypass international payments enabled by American card networks Visa and Mastercard.

In addition to this, the Reserve Bank of India recently announced that eligible travellers from G-20 countries will receive Prepaid Payment Instrument (PPI) wallets that are linked to Unified Payments Interface (UPI) at international airports in Bengaluru, Mumbai, and New Delhi. Delegates attending meetings in various venues can also benefit from this service. ICICI Bank, IDFC First Bank, Pine Labs Private Limited, and Transcorp International Limited, including two non-bank PPI issuers, will issue the UPI-linked wallets. This will allow visitors to experience the convenience of UPI payments at over five crore merchant outlets across India that accept QR Code-based UPI payments.

UPI transactions are expected to strengthen their foothold in the Indian market and become the backbone of the payment infrastructure due to new use cases such as credit card-UPI linkages and international remittances. In the event that India was to be removed from the SWIFT network in the future, sending money home would be extremely difficult for the citizens living abroad. Another issue is that their family members only receive $93.5 out of every $100 sent.

In 2021 alone, the country received more than $87 billion in remittances. According to a World Bank report, India was the first country in the world to receive $ 100 billion from remittances in 2022. Though remittances to the rest of the South Asian countries declined by 10 per cent, they rose by 12 per cent in India’s case.

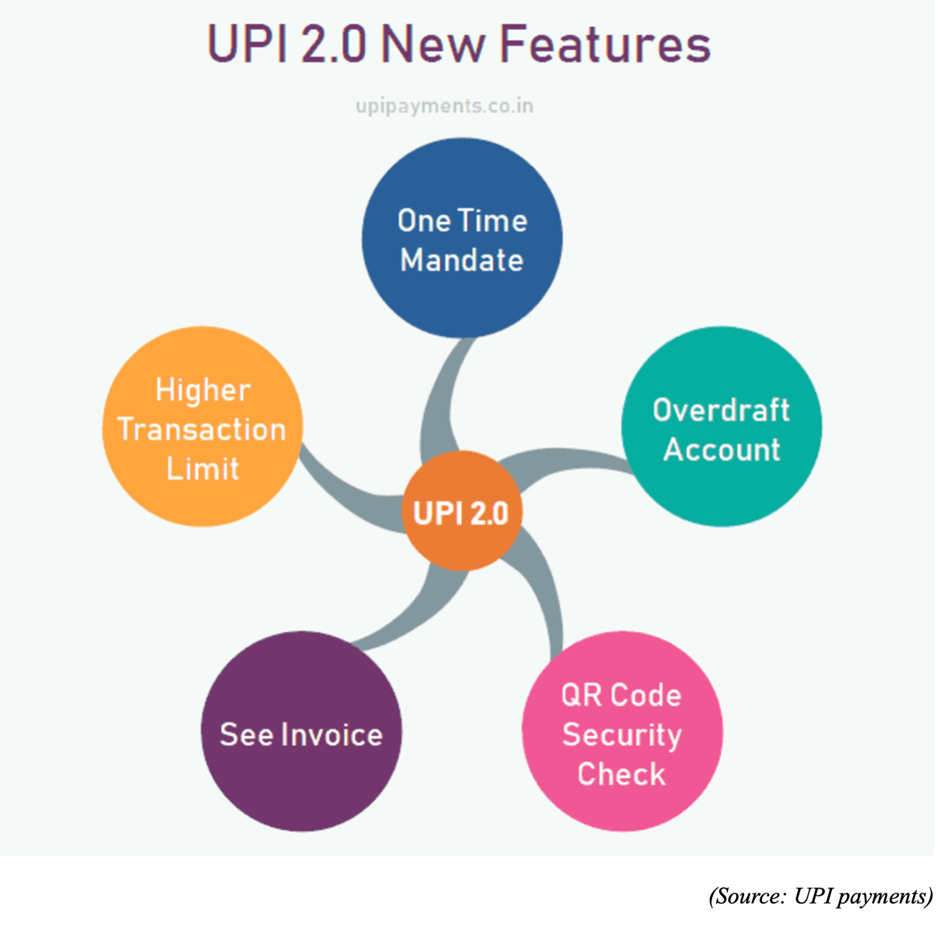

Over the years, UPI has introduced several new features and use cases to enhance its functionality, making it more convenient for people to carry out transactions. Some of the notable advancements that have strengthened UPI's foothold in the market include credit card-UPI linkages, international remittances, and UPI services for feature phones.

The UPI has introduced several features to enhance its functionality, such as credit card-UPI linkages, international remittances, and UPI services for feature phones. UPI 2.0 introduced new features such as linking overdraft accounts, one-time mandates, invoices in the inbox, and signed intent and QR codes for secure and faster transactions. UPI mandate allows pre-authorisation of transactions, while UPI 123Pay allows feature phone users to make payments without internet connectivity.

UPI and SWIFT are two widely used payment systems with distinct differences. So far UPI is designed primarily for domestic transactions within India and has gained widespread popularity due to its ease of use, low cost, and interoperability between different banks and payment providers. On the other hand, SWIFT is a global messaging network that facilitates cross-border payments between banks and financial institutions. SWIFT is used for secure and standardised communication between banks and financial institutions.

UPI does not charge any transaction fee, whereas SWIFT typically charges banks a yearly fee of 2-5% that is transferred to users. UPI has a lower daily transaction limit compared to SWIFT, which connects 11,000 banks and institutions across 200 countries and handles trillions of dollars every day. Although UPI handles transactions worth several lakh crores of rupees every month and provides adaptability and 24/7 operations with a simple interface, it still has a long way to go to before it can seriously compete with SWIFT.

One of the main barriers to the adoption of UPI is a fraud, Government intervention will be required to solve the issue. For 2022–2023, approximately 1 lakh UPI frauds were recorded. Another factor hindering UPI's progress is its current limited scale compared to SWIFT. While UPI can access over 399 banks through 23 apps, it is not very significant in comparison to SWIFT's vast network of banks and institutions globally. Additionally, despite UPI's cost-effectiveness, it still has a lower transaction limit and may not be suitable for large-scale transactions like those handled by SWIFT. Therefore, UPI must overcome these obstacles to become a credible alternative to SWIFT. As more and more financial institutions are onboarded these issues will be smoothed out.

Digital transformation has become a crucial necessity worldwide, and a digital mindset is essential to crafting ecosystem strategies that safeguard the interests of enterprises and countries. Neglecting to adopt a digital mindset may result in disruption and loss of market share. Enterprises must also adapt to the concept of competition, where competition and partnership coexist. The Indian Public-Private Partnership (PPP) framework serves as an excellent model for this. Cebr Economic Research's study shows that India saved $12.6 billion in costs in 2021 due to the implementation of fast payment methods, resulting in a contribution of $16.4 billion (0.56% of GDP) to the country's economy. It is projected that the use of UPI payments will boost India's GDP by $45.6 billion (1.12%) by 2026.