National Medical Devices Policy 2023: Opportunities & Challenges

The newly announced National Medical Devices Policy, 2023, intends to expand India's footprint in the global medical device industry from 1.5% to 10-12% over the next 25 years, resulting in increased sector growth from $11 billion to $50 billion. The policy would help pave the path for India to become an end-to-end healthcare resource centre not just for the country, but also for global accessibility, affordability, quality, and innovation demands.

The policy is aligned with the government's "Atmanirbhar Bharat" and "Make in India" initiatives, which aim to increase domestic investment and medical device production. The goal is to promote missions such as improving access and universality, affordability, quality, patient-centred and quality treatment, preventative and promotive health, security, research and innovation, and skilled people to accelerate the expansion of India's medical devices business. The Policy provides a set of initiatives in six important areas to achieve these aims, including regulatory simplification, enabling infrastructure, supporting R&D and innovation, attracting investments, human resource development, and trade promotion.

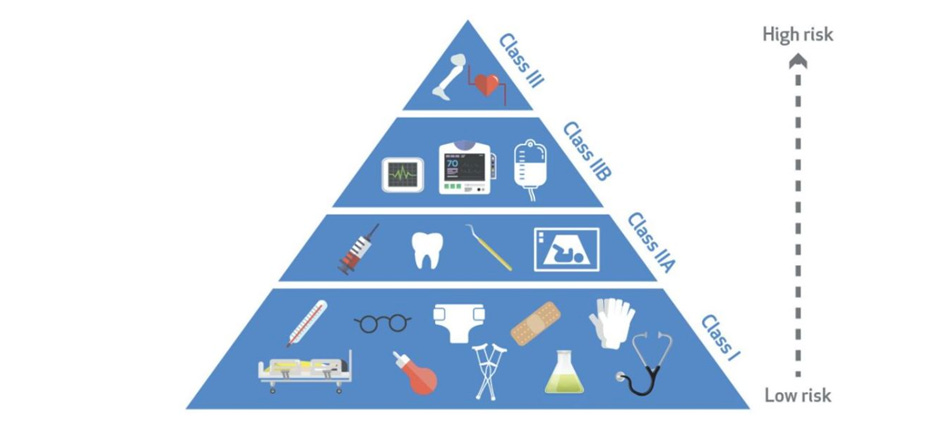

The Medical Devices Rules of 2017 classify medical devices into four categories based on their level of risk, with Class A having the lowest and Class D having the highest level of risk. Class A devices are considered low-risk and do not require regulatory approval. On the other hand, Class D devices are high-risk and require the most stringent regulatory scrutiny.

Class A devices include low-risk items such as stethoscopes, thermometers, and blood pressure monitors, which are exempt from Central Drugs Standard Control Organisation (CDSCO) registration but must adhere to prescribed standards. Class B devices include moderate-risk items such as syringes, surgical drapes, and nebulisers. Manufacturers of Class B devices must register their products with the CDSCO and obtain a registration certificate while complying with prescribed standards.

Class C devices include high-risk items such as blood glucose monitors, implantable devices, and pacemakers. Manufacturers of Class C devices must obtain a license from the CDSCO, conduct clinical trials, and secure a no-objection certificate (NOC) from the CDSCO. Finally, Class D devices include very high-risk items such as artificial hearts, critical care ventilators, and heart-lung machines. Manufacturers of Class D devices must obtain a license from the CDSCO, conduct clinical trials, and secure a NOC from the CDSCO.

India has enormous potential to become self-reliant in this sector and contribute to the goal of universal healthcare. To date, the government has approved 26 projects under the PLI Scheme with a committed investment of Rs. 1206 Crore, of which Rs. 714 Crore has been invested so far. Under the scheme, 14 projects producing 37 high-end medical devices such as linear accelerators, MRI scans, CT scans, mammograms, C-arms, MRI coils, and high-end X-ray tube products have been commissioned and the remaining 12 will be shortly commissioned. In addition, five projects have been approved for domestic manufacturing of 87 products under Category B. The government has also extended its support in setting up 4 Medical Devices Parks in the States of Himachal Pradesh, Madhya Pradesh, Tamil Nadu and Uttar Pradesh.

The vision outlined in the policy is a bright and illuminative, however, there is still a lot that needs to be done in the medical device industry. India's per capita spending on medical devices is one of the lowest at $3 compared to the global average of $47. The industry has been asking for a specific policy on medical devices, and in February 2020, the Centre notified changes in the Medical Devices Rules, 2017 to regulate medical devices in the same way as drugs under the Drugs and Cosmetics Act, 1940.

Although, India is the 4th largest market for medical devices in Asia and among the top 20 markets for medical devices globally, besides being the 2nd largest Personal Protective Equipment (PPE) kits manufacturer, the country's dependence on imported medical equipment has risen to a worrying level, with almost 80% of the domestic requirements being met through imports with most of them coming from the US, Germany, Netherlands, China, and Singapore. According to the Association of Indian Medical Device Industry, imports reached a record high of Rs 63,200 crore in the year 2021-22 from the previous year. China remained the primary importer of India with shipments rising 48% YoY to Rs 13, 538 crores in FY22.

Driving Factors for Growth

India has already become the most populated country in the world. Additionally, life expectancy continues to go up as preventive healthcare becomes accessible and available.

Furthermore, the disease burden is shifting in India, with non-communicable diseases (NCDs) accounting for half of the disease burden and 60% of all deaths. Lifestyle illnesses such as atherosclerosis, heart disease, stroke, obesity, and type 2 diabetes, as well as diseases connected with smoking, alcohol, and drug misuse, are driving up demand for medical devices.

India’s growing middle class, boosted by increasing disposable incomes, and health insurance reforms are expected to drive the demand for medical devices. The medical device industry in India attained a new classification after the launch of the "Make in India" program in 2014, under the government scheme.

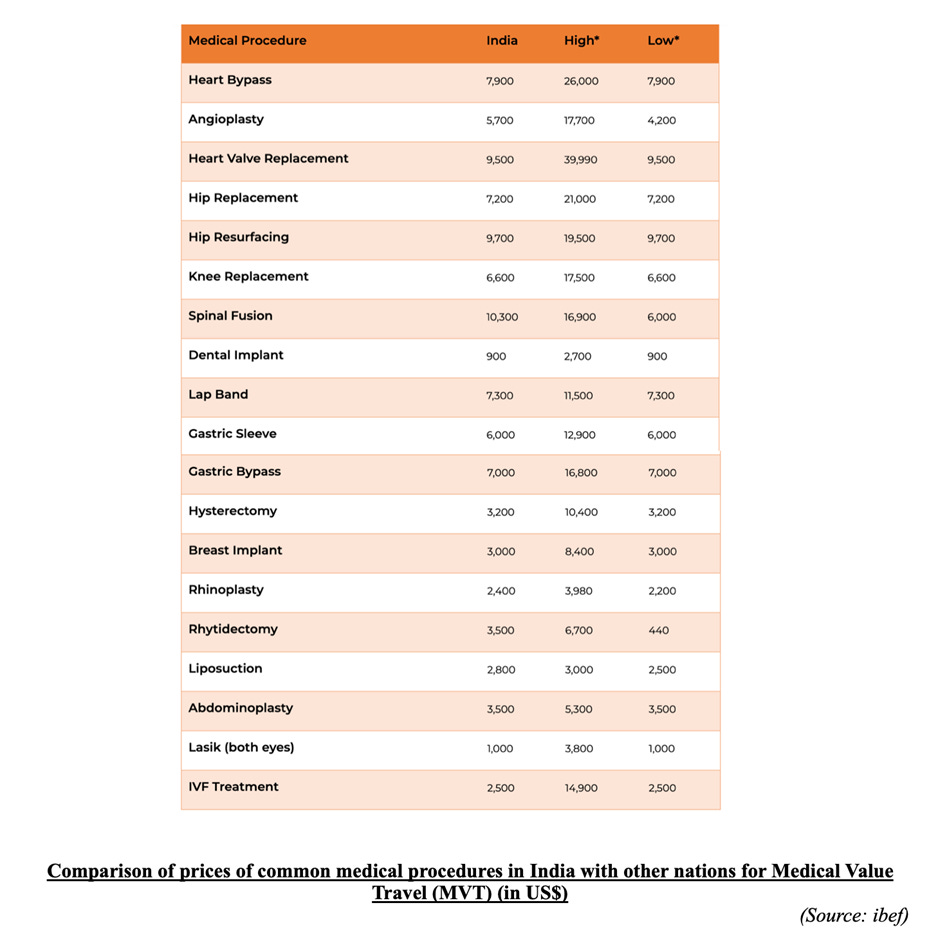

India has emerged as a leader in medical tourism, attracting 186,644 foreign visitors seeking medical treatment in 2020 which is 7% of the total Foreign Tourist Arrivals (FTAs). One of the major factors is lower treatment costs, with prices around one-fourth of those in the US, making India a popular destination for medical tourism. India ranks 10th out of the top 46 countries, 12th out of the world’s top 20 wellness tourism markets, and 5th out of 10 wellness tourism destinations in the Asia-Pacific region based on the Medical Tourism Index 2020-21. With 39 Joint Commission

International (JCI) accredited and 657 National Accreditation Board for Hospitals & Healthcare Providers (NABH) accredited hospitals, India is a reliable and trustworthy destination for medical tourism. Public and private providers contribute to the healthcare sector, while national health policies have aimed to create a more inclusive and structured Universal Health Coverage (UHC) system especially after the launch of Ayushman Bharat.

The new policy aims to reduce this dependence to 30% in 10 years and make India a top 5 global manufacturing hub for medical devices by 2047. India's medical device industry has enormous potential, but it needs to overcome these challenges. The new policy framework is a step in the right direction, and with the right support and infrastructure, India can become a leading global player in the medical device industry.

New Trends in Medical Devices

Medical technology and medical devices continue to evolve rapidly, bringing innovative solutions. From Big Data to Wearables to Robotics, the industry is seeing rapid innovation and growth. Here are some of the latest trends in medical devices:

Big Data: Companies are using predictive analytics models to gather patients’ vital data to make informed decisions for the patient's health. For example, Medtronic and IBM have developed a mobile personal assistant application that provides real-time glucose insights helping the individual understand the links between glucose readings, lifestyle choices and drug administration. Cipla launched 'Spirofy', India's first pneumotach-based portable, wireless spirometer to monitor lung condition.

New Devices: Innovative devices are being developed to address challenges in the healthcare system, such as the InsuliCool product range by Godrej Appliances for insulin storage. Medtronic India launched Micra AV - a miniaturised, fully self-contained pacemaker that delivers advanced pacing technology to atrioventricular (AV) block patients via a minimally invasive approach.

Wearables: Wearables such as glucose monitors, exercise trackers and wearables for mental health are becoming increasingly popular among consumers due to their ease of use. Recently launched Ultrahuman Ring, which can track users' metabolism, and measure movement, sleep, and other body dynamics in real-time.

Robotics: India has witnessed significant developments in robotics, particularly in the field of surgical robots. The Rajiv Gandhi Cancer Institute and Research Center received its first Made-in-India surgical robotic system, while Medtronic launched a Surgical Robot Experience Center to train surgeons in robot-assisted surgery. Siemens Healthineers also introduced Corindus, a robotic system for cardiovascular interventions. Startups such as SS Innovations are developing surgical robotic systems, and Medtronic's SREC focuses on surgeon education and training.

The National Institute of Pharmaceutical Education and Research now offers a Master in Technology in Medical Devices, highlighting the promising future of the industry in India due to continuous investment, innovation, and research.