Financial Influencers, Crypto, and the IP Road Ahead

Cryptocurrencies are a decentralised digital or virtual currency that uses encryptions and cryptographic techniques to secure and verify transactions. The entire system of crypto works on the blockchain which is a decentralised database distributed across

Since the establishment of “bitcoin” in 2008 as the world’s first major cryptocurrency, by the pseudonymous Santoshi Nakamoto (identity of the group or individual unknown), multitudes of cryptocurrencies have come into existence. From Bitcoin to Ethereum to Dogecoin, there are over 20,000 digital currencies in circulation worldwide. The number of these currencies is bound to increase in absence of any proper legal framework to regulate their creation and circulation. The roots behind the modern-day digital currency are the “Chaumian blinding” or the “blinding algorithm” techniques introduced by David Lee Chaum in his paper “Blind Signature for Untraceable Payments” in the 1980s.Young people look at cryptocurrencies as shortcuts to easy and quick money. But, in absence of blockchain and crypto literacy, these young investors are turning to social media platforms and Finfluencers for financial advice. Like Ankur Warikoo said, “For Gen-Z and millennials, YouTube is a university now in India.” The steady grip of the concept of crypto over the countries of the world raises many questions regarding, ownership, Intellectual Property, and legal frameworks.

But, what exactly is Cryptocurrency, and why everyone is talking about it? Cryptocurrencies are a decentralised digital or virtual currency that uses encryptions and cryptographic techniques to secure and verify transactions. The entire system of crypto works on the blockchain which is a decentralised database distributed across several nodes in a computer system. Bitcoins has its own blockchain, and Ethereum has its own blockchain. The advanced coding used in the storing and transmission of crypto data between these digital ledgers and the decentralised system of recording transactions makes it nearly impossible to hack into a blockchain. These currencies can be used in various applications, online games, and virtual worlds.

Global Crypto Industry:

Globally, the crypto industry is expected to hit $2.3 billion by 2026 and cross $1.6 billion in 2021. According to data acquired by Finbold, about 10.2 percent of the global population using the internet owns some form of cryptocurrency (as per a survey carried out in Q3, 2021 and published on January 26, 2022), with Bitcoin being the first-largest currency by market cap nowadays.

Indian Crypto Industry:India's crypto industry has grown 39.7% over the past five years from $ 53.1 million in 2016 to $ 74.2 million in FY21, according to a report by the National Association of Software and Services Companies (NASSCOM) in collaboration with WazirX. The Indian crypto tech market size is expected to reach $241 million by 2030, growing at a CAGR of 14% and potentially creating 877 thousand jobs. In the below graphs, the Base Case is nothing but the growth and adoption of crypto tech in India continuing at its current rate due to: Limited changing policy environment, and ongoing uncertainty due to COVID-19 and the crypto tech integration in business functions and the financial sector grows at the pace slower than required to achieve critical mass and usage across sectors. The Best Case scenario is that the growth and adoption of crypto tech in India accelerate rapidly with two-sided growth – higher demand-pull and investments in the development and maturity of crypto tech.

In India, Cryptocurrencies are declared as virtual digital assets which are taxed but are not regulated. In 2018, the RBI prohibited all banks and financial institutions to deal in or facilitate the transaction of cryptocurrency. This blanket ban was challenged in the Supreme Court. The Court in the matter of Internet and Association of India vs. Reserve Bank of India lifted the ban imposed by RBI.

The evolution of social media platforms has changed the landscape of financial investment. People of any educational background or profession, students and some even without any degree are giving out financial advice to lakhs of people on how and where to invest their hard-earned money, they are suggesting stocks, cryptos, mutual funds, etc that could give them 100% returns in a short duration of time. In Oct 2021 the market regulator Securities and Exchange Board of India (SEBI), banned the investment advisors from advising on cryptocurrencies, digital gold and other unregulated products and engaging in unregulated activities as they were not in accordance with the provisions of Section 12(1) of the SEBI Act, 1992.

Recently in May 2022 SEBI suggested that no celebrities and sportsmen, or any prominent public figures should endorse crypto products. The Internet and Mobile Association of India has dismantled the Blockchain and Crypto Assets Council which was formed to represent cryptocurrency exchanges and startups working in the blockchain and related space. The Blockchain and Crypto Assets Council was dissolved as the view of RBI had not changed on crypto, recently RBI Governor Shaktikant Das termed crypto “clear danger”.

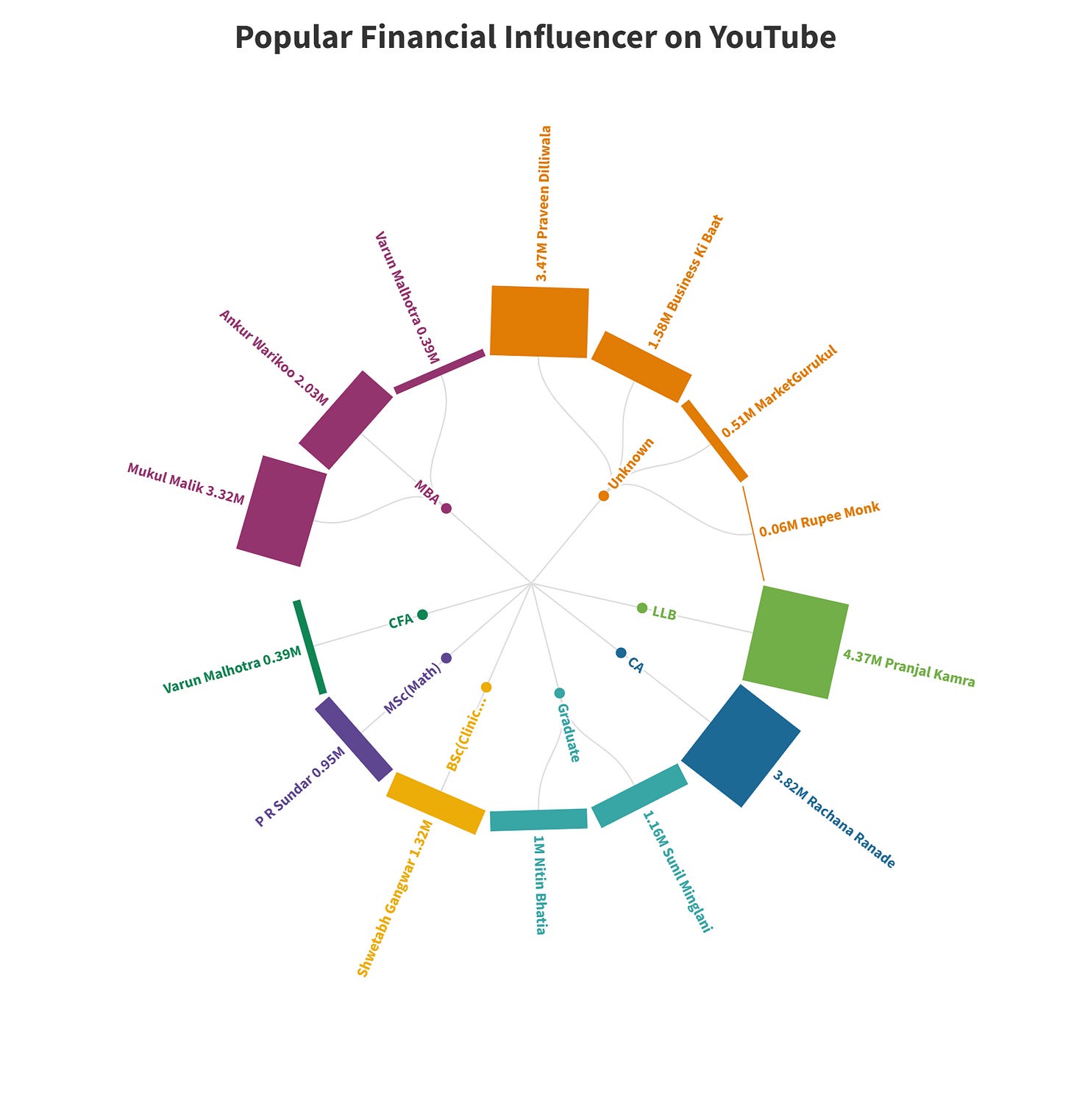

As per Government data, the country has 2.75 crore mutual fund investors and 7.38 crore, Demat account holders, as on 31st October 2021 and the number of SEBI registered investment advisors is 1,324. The figure shows that for 76,510 investors there is only 1 advisor. The number of Registered Investment Advisors remains more or less stagnant in India as it has increased to only 1329 in July 2022. But, what about the thousands of investment advisors that are out there on social media platforms like Instagram, Youtube, and telegrams? Who regulates them, and under what eligibility criteria do they advise people to invest their money in stocks or cryptos that they suggest? In order to become an Investment advisor in India, an individual must get themselves registered with SEBI if they are eligible as per Regulation 7 of the Investment Advisor Act 2014.

The Google search trend reveals the percentage of keyword search ‘stock’ and ‘crypto’ for the last five years from 2 August 2017 to 2 August 2022. The below figure shows that out of these two searches, Nigeria is the highest ‘crypto’ searched country followed by France, Netherlands, Romania, and Indonesia whereas Bangladesh is at the top rank in ‘stock’ keyword search, followed by Canada, Israel, and South Korea. In India, 91% of the searches are ‘stock’ and only 9% of ‘crypto’ keyword searches. Please note that these percentage is calculated out of searches for all two terms (stock and crypto) in a country.

The mystic nature and grey zone of blockchain technologies, cryptocurrencies, and the increasing number of users for these virtual currencies have posed new questions in the absence of any legal framework surrounding it. There has been growing tension between the rise of innovation with blockchain technologies and the IP Laws. The IP laws have not yet been used in the blockchain industry, though depending on the situation IP can either encourage or stifle innovation. The challenges with traceability of transactions in the public ledger make it uncertain to determine the ownership. In recent times the number of patent and trademark filings has increased in the countries like the USA, China, and the EU for “bitcoin” and “cryptocurrencies”.

Recent Trademark cases might give us a glimpse of the future:The Delhi High Court in the matter of Tata Sons Private Limited vs Hakunamatata Tata Founders & Ors, where the defendants dealt with crypto under the name of TATA coin/ $TATA, refused to grant protection against such use because the defendant was situated outside India and Indian customers were not targeted directly.

In the case of West vs McEnery, the court of New York passed the judgment in favour of rapper Kanye West to desist the defendants from using the name “Coinye West” as the trademark for their cryptocurrency brand.In the matter of Alibaba Group Holding Ltd vs. Alibabacoin Foundation, the U.S District judge rejected Alibaba’s lawsuit against the defendant for trademark infringement of its trademark Alibaba as a new cryptocurrency.

The era of information and technology has opened many opportunities. Financial education through social media has become easy and many eager for advice consider it to be a game changer but, what works for one, might not work for another. The nature of the content of most social media videos and posts is to catch the attention of maximum people in the shortest time possible which oftentimes leads to the omission of crucial pieces of information. We all are aware that the world is full of tricksters and scamsters, before making any investment it is necessary to do your own research. Getting caught up in the internet trends can lead to financial losses and other serious consequences.